In the realm of finance and investment, two critical metrics, Internal Rate of Return (IRR) and Return on Investment (ROI), stand out as fundamental tools for evaluating the profitability of projects or ventures. While they both provide valuable insights into the financial performance of an investment, they serve distinct purposes and utilize different methodologies. In this article, we delve deep into the world of IRR and ROI, dissecting their characteristics, applications, and the nuances that set them apart.

Key Concepts: IRR and ROI

Internal Rate of Return (IRR) Explained

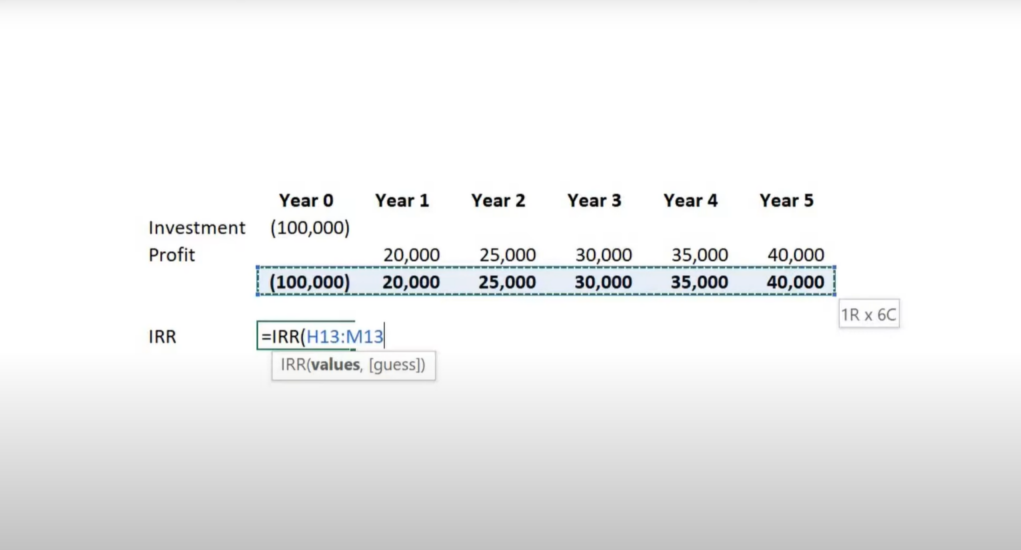

Internal Rate of Return (IRR) is a metric that gauges the potential profitability of an investment by calculating the discount rate at which the net present value (NPV) of cash flows becomes zero. In simpler terms, it is the rate at which an investment breaks even in terms of cash flows. IRR considers the time value of money, making it a powerful tool for comparing different investment opportunities. This metric is particularly useful for assessing the feasibility of long-term projects or ventures with irregular cash flows.

Return on Investment (ROI) Unveiled

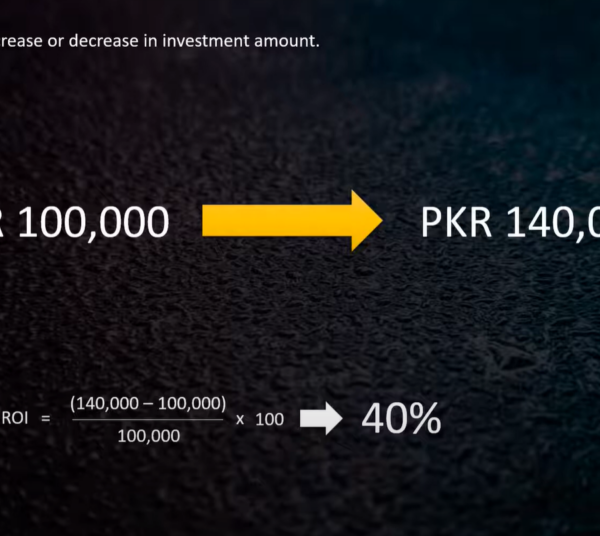

Return on Investment (ROI), on the other hand, measures the profitability of an investment by comparing the net profit generated to the initial cost of the investment. Expressed as a percentage, ROI provides a straightforward way to evaluate the efficiency of an investment. It is especially popular among investors and business owners seeking to assess the success of a particular venture.

Differences Between IRR and ROI

Methodology Matters

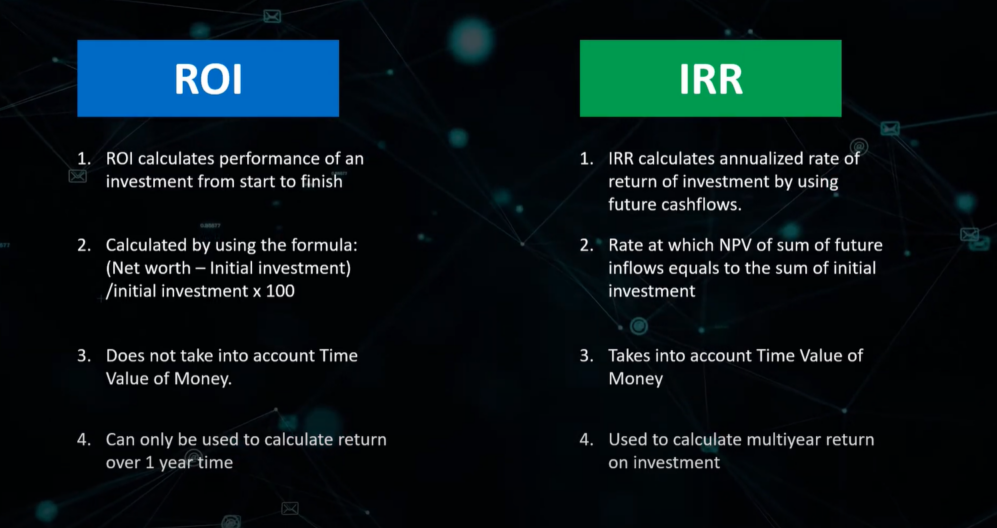

When it comes to methodology, IRR and ROI take divergent paths. IRR relies on the concept of discounting future cash flows to their present value, striving to find the rate that makes the project’s NPV zero. In contrast, ROI focuses solely on the relationship between net profit and initial investment, ignoring the timing and magnitude of cash flows.

Time-Weighted vs Money-Weighted Returns

Comparison of IRR and ROI

| Aspect | IRR | ROI |

|---|---|---|

| Calculation | Considers time value of money | Focuses on profit relative to investment |

| Cash Flow Timing | Incorporates cash flow timings | Ignores cash flow timings |

| Project Scale | Suitable for long-term projects | Applicable to projects of any duration |

| Complexity | Can be complex for irregular flows | Simpler calculation |

Flexibility and Investment Types

IRR is well-suited for projects with fluctuating cash flows over an extended period, making it ideal for evaluating ventures like real estate or infrastructure development. Conversely, ROI is more versatile, capable of assessing a wide range of investment types, from short-term trades to long-term endeavors.

Applications in Decision Making

Navigating Complex Projects with IRR

IRR Application Example

Consider a renewable energy project with significant upfront costs and intermittent revenue streams. Calculating the project’s IRR will help assess its viability and whether it provides a satisfactory return over its lifespan.

ROI’s Role in Business Ventures

ROI Application Example

A tech startup invested $100,000 in research and development for a new software product. If the product generates $50,000 in profit, the ROI would be 50%, indicating a favorable outcome.

Importance of Clear Decision-Making

Making informed investment decisions hinges on understanding the nuances of IRR and ROI. While IRR highlights the project’s potential rate of return, ROI offers a clear percentage indicating profitability. Choosing the appropriate metric depends on the investment’s nature and the investor’s priorities.

Factors Influencing IRR and ROI

IRR Factors to Consider

- Cash Flow Patterns: The timing and consistency of cash flows significantly impact IRR. Irregular cash flows can lead to multiple IRRs or complex calculations;

- Project Scale and Duration: Longer-term projects with higher initial costs might yield favorable IRRs, but they also carry higher risks;

- Discount Rate: Adjusting the discount rate can alter the IRR. A higher rate can make an investment less appealing.

ROI Factors to Keep in Mind

- Initial Investment: ROI is directly affected by the initial amount invested. A lower investment can lead to higher ROI, even if the net profit is modest;

- Net Profit Variation: Fluctuations in net profit can greatly influence ROI. Smaller profits relative to investment might result in lower ROI;

- Evaluation Period: The chosen evaluation period impacts ROI. A shorter period might inflate the ROI, while a longer period can dilute it.

Comparing Interpretations: IRR and ROI

Understanding IRR Interpretation

- Investment Acceptance: If the calculated IRR is higher than the required rate of return, the investment is generally considered acceptable;

- Multiple IRRs: Complex projects with multiple cash flow changes can lead to multiple IRRs, complicating the decision-making process.

Unraveling ROI Interpretation

- Percentage Benchmarking: ROI’s straightforward percentage format allows for quick comparisons against industry benchmarks and other investments;

- Profitability Insights: A high ROI indicates efficient use of resources, while a low ROI might prompt reevaluation or strategic changes.

Real-Life Examples: IRR and ROI in Action

Case Study: IRR in Real Estate Development

In a real estate project, the IRR plays a crucial role in determining the viability of the investment. For instance, if a property developer plans to build a housing complex, calculating the IRR would consider construction costs, periodic rental income, and eventual property sale. The IRR calculation assists in evaluating whether the potential return justifies the initial investment and ongoing costs.

Case Study: ROI for Marketing Campaigns

Imagine a company launching a digital marketing campaign. By tracking the campaign’s expenses and measuring the resulting increase in sales, the ROI can be determined. If the ROI is positive and meets the company’s goals, it signifies a successful campaign. Conversely, a negative ROI might prompt a reassessment of the marketing strategy.

Choosing the Right Metric for Your Scenario

When to Prioritize IRR

- Long-Term Investments: IRR shines when evaluating projects with extended timeframes and fluctuating cash flows;

- Complex Cash Flows: If your investment involves irregular or changing cash flows, IRR’s time-based calculations provide clearer insights.

When ROI Takes the Lead

- Quick Comparisons: When you need a swift assessment of an investment’s efficiency, ROI’s percentage format is your go-to tool;

- Short-Term Ventures: For shorter projects with predictable cash flows, ROI offers a simpler way to gauge profitability.

Risk Assessment: Evaluating IRR and ROI

Assessing Risk with IRR

- Sensitivity Analysis: IRR is sensitive to changes in cash flow assumptions. Conducting sensitivity analysis helps identify how variations in inputs impact the IRR;

- Varying Discount Rates: Altering the discount rate used in IRR calculations can provide insights into the project’s robustness against changing market conditions.

Risk Evaluation through ROI

- Risk-Aware ROI: ROI can provide a simplified view of risk by focusing on the profit relative to the investment, but it doesn’t consider the project’s cash flow timings;

- Comparing Different Ventures: ROI allows for direct comparisons between investments with varying risk levels, making it useful for assessing risk-return trade-offs.

Caveats and Limitations of IRR and ROI

Irrational IRR Interpretations

- Mutually Exclusive Projects: IRR might favor higher returns even if the investment has a smaller overall value. In such cases, relying solely on IRR can lead to suboptimal decisions;

- Reinvestment Assumption: IRR assumes that cash flows can be reinvested at the calculated IRR, which might not always hold true.

ROI’s Simplistic View

- Ignoring Cash Flow Timing: ROI disregards the timing of cash flows, potentially overlooking projects with irregular or back-loaded returns;

- Overlooking Investment Scale: A high ROI might overshadow the fact that the absolute profit is still low due to a small initial investment.

Application Scenarios: When to Pivot

Recognizing IRR-Driven Pivots

- Multiple IRRs Dilemma: Complex projects with multiple cash flow changes might lead to conflicting IRRs, prompting a reevaluation of the investment’s feasibility;

- Unattainable IRRs: An IRR that surpasses the cost of capital might signal unrealistic assumptions or errors in the calculation, necessitating adjustments.

Reacting to ROI Signals

- Negative ROI Insights: A negative ROI doesn’t always warrant abandonment. It could indicate short-term setbacks or the need for strategic adjustments;

- Diminishing Returns: As ROI approaches a certain threshold, additional investment might not yield proportional returns, indicating the need to pivot resources.

Integrating IRR and ROI for Informed Decisions

Comprehensive Investment Analysis

- Holistic Perspective: Utilizing both IRR and ROI offers a comprehensive view of an investment’s potential returns and its profitability relative to the initial investment;

- Risk-Return Harmony: By considering IRR’s complex cash flow analysis and ROI’s simplicity, decision-makers can strike a balance between risk and return.

Integrating IRR and ROI

| Aspect | IRR | ROI |

|---|---|---|

| Strengths | Captures cash flow timing and time value of money | Provides straightforward percentage |

| Weaknesses | Complex for irregular cash flows | Ignores cash flow timings |

| Use Cases | Long-term projects, complex ventures | Short-term and varied investments |

| Integration Value | Offers risk insights; gauges project viability | Provides profitability perspective |

Evaluating Investment Quality: IRR and ROI

Digging Deeper into IRR Analysis

When delving into investment quality assessment, Internal Rate of Return (IRR) unveils its capacity to consider both the timing of cash flows and the opportunity cost of capital. A higher IRR signifies a potentially more lucrative investment, but its complexity arises when projects have irregular cash flows, leading to multiple IRRs or even unattainable solutions. Therefore, while IRR is a powerful metric, it requires a thorough understanding of the project’s cash flow patterns to ensure its accurate interpretation.

ROI’s Role in Quality Appraisal

Return on Investment (ROI), on the other hand, takes a simpler approach by focusing solely on the profit generated relative to the initial investment. When evaluating investment quality, ROI offers a concise insight into the effectiveness of resource utilization. However, it tends to overlook the nuances of cash flow timings and can yield high values even for smaller investments. This highlights the importance of considering the investment’s scale and industry benchmarks when interpreting ROI as a measure of investment quality.

Complexity in Real-World Applications: IRR and ROI

Navigating Complex Projects with IRR

In real-world scenarios, complex projects often come with fluctuating cash flows, and this is where IRR shines. For instance, consider a large infrastructure development project that involves substantial initial costs, subsequent cash inflows from rentals, and a significant final cash flow from property sale. Calculating the IRR allows project managers to assess the project’s feasibility over time, accounting for the time value of money and the irregular nature of the cash flows.

ROI Challenges in Varied Ventures

While Return on Investment (ROI) provides a straightforward measure of profitability, applying it to diverse ventures can be challenging. Take the example of a startup in the pharmaceutical industry investing in research for a groundbreaking drug. If the initial investment is substantial and the net profit is comparatively low due to regulatory hurdles, the ROI might appear unfavorable. However, the potential long-term benefits and societal impact of the drug can’t be accurately captured by the ROI alone.

Beyond the Numbers: IRR and ROI’s Strategic Insights

IRR: Beyond the Bottom Line

Internal Rate of Return (IRR) is more than just a financial metric; it offers strategic insights. For instance, if a technology company calculates the IRR for a new software development project, it might find that the IRR is promising, indicating potential profitability. However, by examining the IRR sensitivity to varying assumptions, such as development time or market demand, the company gains a deeper understanding of which factors hold the most influence over the project’s success.

ROI’s Influence on Resource Allocation

Return on Investment (ROI) significantly impacts resource allocation decisions. Imagine a retail chain analyzing the ROI of expanding its physical stores versus investing in an e-commerce platform. Even if the e-commerce ROI is higher, the retail chain might opt for the physical store expansion to maintain its brand presence and customer experience. This exemplifies how ROI goes beyond numbers, influencing strategic choices that align with broader business goals.

Emerging Trends: IRR and ROI in Modern Finance

Evolving Metrics in Technology-Driven Finance

In the realm of modern finance, technology is reshaping how we analyze investments. Machine learning algorithms and AI-powered tools are enhancing the accuracy of IRR predictions by crunching vast amounts of historical data. Similarly, ROI calculations are becoming more sophisticated by incorporating predictive analytics to forecast future revenues and costs. This evolution in measurement techniques ensures that investment decisions are more informed and aligned with the dynamic nature of today’s markets.

Synergizing Metrics in Sustainable Investing

The shift towards sustainable investing has brought IRR and ROI into sharper focus. Investors not only consider financial returns but also assess environmental, social, and governance (ESG) factors. IRR aids in evaluating the long-term financial viability of sustainable projects, while ROI highlights the immediate financial benefits. Integrating these metrics allows investors to make ethical and profitable decisions, contributing to a more responsible financial landscape.

Striking a Balance: IRR and ROI Integration

Holistic Insights through Combined Analysis

By synergizing the powers of Internal Rate of Return (IRR) and Return on Investment (ROI), decision-makers can achieve a more comprehensive understanding of their investments. This integrated approach leverages IRR’s ability to account for the time value of money and cash flow timings, while harnessing ROI’s simplicity to assess profitability. Such a balanced analysis enables individuals to evaluate not only the returns but also the investment’s quality, risk, and alignment with strategic objectives.

Scenario-Based Decision Making

Incorporating both IRR and ROI into the decision-making process allows for dynamic scenario analysis. For instance, an energy company considering a wind farm project can calculate both the IRR and ROI under varying assumptions, such as fluctuating energy prices and maintenance costs. By assessing how changes in these variables impact both metrics, the company gains valuable insights into the project’s resilience and potential in different market conditions.

Conclusion

In the world of finance, understanding the differences between Internal Rate of Return (IRR) and Return on Investment (ROI) is paramount. IRR illuminates the potential returns while considering the time value of money and cash flow timings, making it indispensable for complex, long-term projects. On the other hand, ROI simplifies the assessment by focusing on the profit relative to the initial investment. Armed with a comprehensive knowledge of these metrics, investors and decision-makers can navigate the financial landscape with confidence.

FAQs

ROI is more suitable for assessing short-term investments due to its simplicity and focus on initial investment and net profit.

Yes, IRR can be negative. It indicates that the investment’s cost of capital exceeds the project’s rate of return.

Not necessarily. While a higher IRR is generally favorable, it should be evaluated alongside other factors like risk and project scale.

ROI treats all cash flows equally, which might not accurately reflect the project’s profitability over time.

Yes, using both IRR and ROI can provide a more comprehensive view of an investment’s potential.